With Zohran Mamdani, Everything That Has Already Failed Is New Again

/Our newly-anointed Mayor-elect, Zohran Mamdani, vows that he is a Socialist, and that he intends to implement an explicitly Socialist suite of policies. OK, the guy is only 34 years old. He was born on October 18, 1991, just a couple of months before the final collapse of the Soviet Union on the day after Christmas that year. He lacks the personal experience that we senior citizens have of reading every day for decades of the horrors of life in Brezhnev’s Soviet Union, or Mao’s China. But could a student really learn so little in fancy schools like Bronx Science and Bowdoin College that he could graduate in the 2010s and not know about this history? Shockingly, yes.

And yet it gets worse. Socialism a la Mamdani does not involve the classic prescription of “seizing the means of production.” We have essentially nothing in today’s New York City in the way of “means of production” that you could usefully seize. There is almost no heavy industry or even light manufacturing left in New York City. Go into the big office buildings where people make high incomes and you will find literally nothing to seize that will enable you to produce what they produce. It’s just a bunch of standard-issue laptops. The high earners are making the money off their wits.

So the “Socialist” policies advocated by Mamdani are different, more akin to the standard progressive playbook of a greatly expanded handout state financed by higher income taxes on the high earners. Of the various policies that Mamdani has advocated, the three that I think are most significant in their potential impact on the City are: (1) raising income taxes on high earners, (2) having the City as developer build 200,000 new publicly-owned “affordable” housing units, and (3) “defunding” and/or downsizing the police department.

To Mamdani and his twenty- and thirty-something acolytes, all this stuff seems so terribly new and fresh and creative. But the funny thing is that all of these policies have been tried before in New York. They were all implemented well before Mamdani was born, and then reversed by the time he was a little kid. In each case the reversal occurred because the policy had abjectly failed.

I seriously doubt that Mamdani knows anything about the history. So let’s have a review.

Raising the income tax rate on the highest earners

Here are three sources that, taken together, give the history of top income tax rates in New York State all the way from 1919 (when the State income tax was first imposed) to 2024: this one from the State Tax Department covers 1919 to 1997; this one from the Fiscal Policy Institute covers 1976 to 2007; and this one, again from the State Tax Department, provides the most recent data.

As relevant here, at the State level the top rate moved up through the single digits in the 1940s and 50s, until it hit 10% in 1959 — and then they started to go really crazy. From 1961 to 1968 the top rate was 14%, and then it went to 15% from 1969 to 1977. After 1977, they started to back off, with the top rate dropping to 10% by 1981, and then by smaller increments through the 80s and 90s until hitting a low of 6.85% by 2000. Since then, they have mostly kept the 6.85% rate on incomes under $2 million, but have added some new premium rates on incomes above that level, up to a current top rate of 10.9% on incomes over $25 million.

And then there is the additional New York City income tax. It was first instituted in 1966, with a top rate of 3.876%, and the rates have fluctuated modestly since then around an average of about 4%. The current top rate is actually the same 3.876% as when the tax first began. During his eight years as Mayor, Bill de Blasio constantly tried to get the State Legislature to raise the top rate for high earners, but he never succeeded.

Thus the combined top State/City income tax rate hit almost 19% in the 1970s. At this same time, the top federal rate was 70%. In those days, State and City income taxes were fully deductible from federal. So if you earned a dollar, paid 19 cents to the State and City, and then paid 70% of the remaining 81 cents to the feds, you ended up with only about 24 cents of the dollar for yourself. The top federal rate then came all the way down to 28% by the 1986 Tax Reform Act, before beginning its inexorable rise once again when President George H.W. Bush broke his pledge of “Read my lips: no new taxes.”

New York City building “affordable”/low income housing as developer

In 1935, New York City created the New York City Housing Authority as a vehicle to build what was then called “low income” housing. Construction did not really get going until after World War II. In total, NYCHA built about 180,000 units of housing, almost all from the 1950s to early 1980s. The NYCHA units were all were built on the pure socialist model, with the City acting as owner and developer, providing the financing (through tax exempt bonds), and then renting the apartments to tenants at rents set by statutory formulas based on tenant income, rather than by a housing market.

In the mid-1970s, the construction of NYCHA buildings hit a big roadblock when the City had a financial crisis, nearly defaulting on its debt in 1975. The deal to keep the City out of bankruptcy dramatically reduced its ability to continue to take on large amounts of debt for public housing. Construction of NYCHA projects slowed, but continued into the 80s at a lower pace, until the 1986 Tax Act. That law set limits on the amount of debt that a municipality could take on and qualify for tax exempt status on the interest. Since the 1986 Tax Act took effect, there has been very little further NYCHA construction. Essentially, the City ran out of other people’s money for this purpose.

Size of the New York City Police Department

According to this New York Times piece from December 6, 1981, the New York Police Department reached a then-peak of some 30,911 officers in 1970, and maintained approximately that strength until 1975. That was the year that the City’s financial crisis hit, and hiring for the Department was completely suspended. By 1978 the number of officers was down to 24,670, and by the time of the article in late 1981 it was 22,170. Mayor Ed Koch, who took office in 1978, began a re-hiring program when finances permitted in the early-1980s. By 1990 (when Mayor David Dinkins took office) the number of officers was back up to about 28,000, and by 1993 (when Rudy Giuliani replaced Dinkins) it was about 37,000. The all-time high of about 40,000 was reached in 2000, toward the end of Giuliani’s time. Since then, the number has gradually declined to a current figure of about 33,000.

Outcomes associated with these policies

Population

Many are currently warning Mayor-elect Mamdani that he risks serious flight of the high-earning taxpayers if he implements significant tax rate increases on the top brackets. For myself, I don’t think that large numbers can or will leave suddenly. Instead, the consequence of such policies is gradual relative decline, as people slowly make decisions to relocate as family and job circumstances permit.

Nevertheless, the history of New York’s population in the 1970s and 80s gives a serious indication of how rapid the population consequences of bad tax policy can be. Here is a Wikipedia entry with census data for New York City for the recent decades. In 1960 New York City’s population hit a then-record of 7,781,984. In the following decade, the State upped its top rate to 14%, and in 1966 the City instituted its own approximately 4% rate. By 1970, the population had inched up to 7,894,862. The late 1960s also saw the beginnings of a surge in crime (see next section). At the end of the 60s, the State pushed its top tax rate up a final point to 15%.

And in the 1970s, the population of New York City fell off a cliff. By 1980, the City’s population was down to 7,071,639 — a loss of more than 10% of the population in that single decade.

Hugh Carey had become Governor in the late 1970s, and the start of the decline in top tax rates in the late 1970s and early 1980s was very much a program on his part to correct what he perceived as New York having become completely uncompetitive in its tax rates. The decline in tax rates continued under Governor Mario Cuomo (taking office in 1983), who again perceived that lower taxes were necessary to keep New York competitive.

And sure enough, the City’s population began to recover, reaching 7,322,564 by 1990, and then 8,008,278 by 2000 (as tax rates continued their decline through the 1990s). By 2020 the City’s population had reached 8,804,190.

Meanwhile, New York State income tax revenues surged during the 1980s even as the top rates declined dramatically. To be fair, the biggest cause was external to the state: when the feds lowered their top rate from 70% to 28% by the 1986 Tax Act, that unleashed a gusher of previously-suppressed capital gains realizations, on which New York State collected its share. Still, it is hard not to see the wildly uncompetitive income tax rates of the 1970s as a prime cause, along with the crime surge, in the major population decline.

Crime

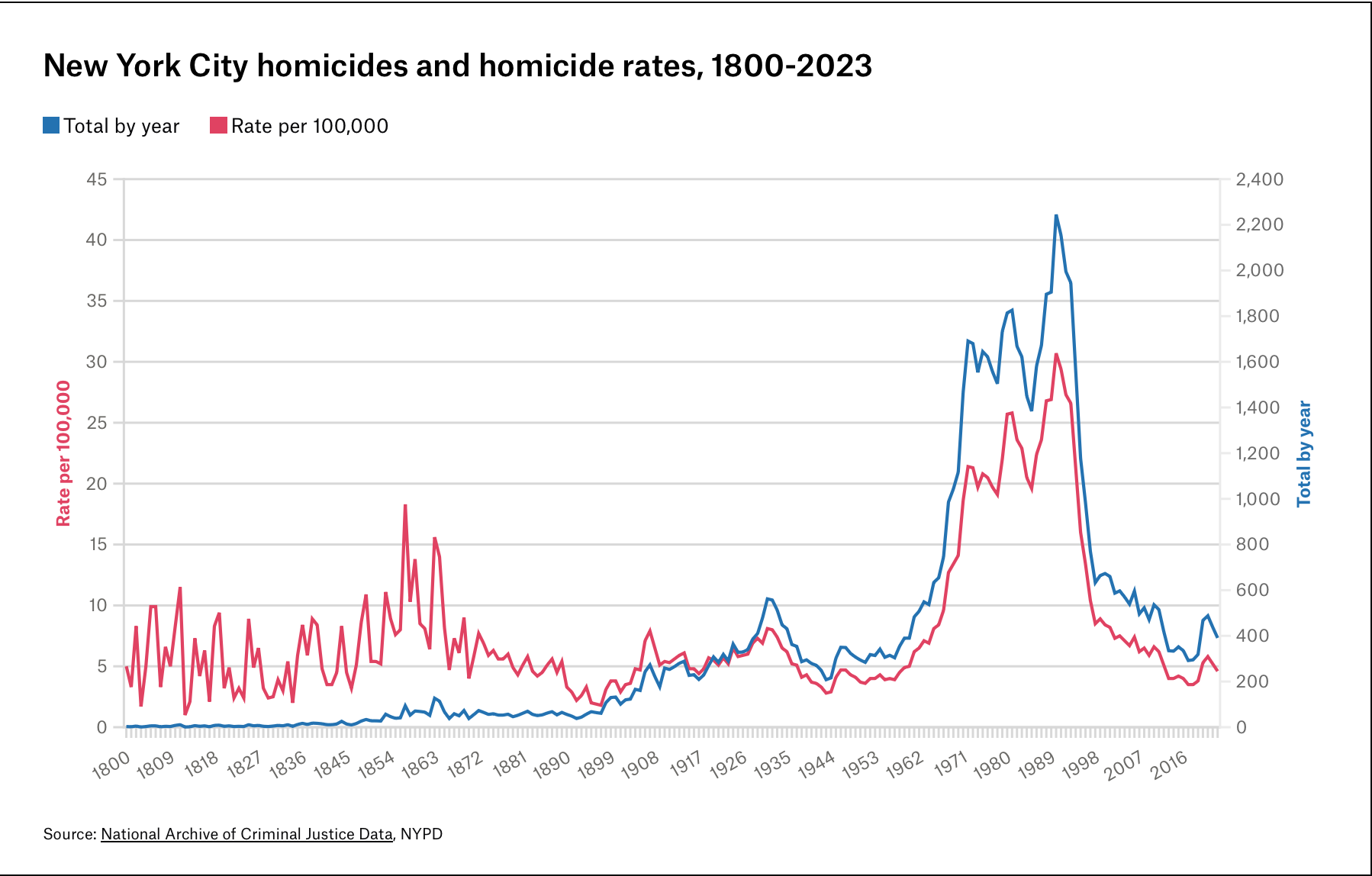

Here from a source called Vital City is a chart of New York City’s number of murders and murder rate from 1800 to 2023.

You can see that the murders began their sharp increase in the mid-1960s, which was before the decline in the number of police. So it is not possible to attribute the initial increase in crime to matters of policing. Other factors likely involved were a lax attitude toward law enforcement beginning in the 1960s (Mayor Lindsay!), a surge in welfare dependency, and a large influx of poor people from the South. You may have other favorite causes to cite.

But it is also clear that the sharp decline in crime in the 1990s did not begin and continue until the numbers of police got back to high levels and the City again got serious about enforcing the laws. Note that, to his credit, the peak in manpower and the re-introduction of serious enforcement began under Mayor David Dinkins (beginning 1990), although it intensified under Mayor Giuliani (1994 through 2001) and continued under Mayor Bloomberg (2002-2014).

City-developed affordable housing

Today, some 40 years after the City’s construction of public housing ground to a halt when the money ran out in the mid-1980s, Mamdani proposes to get back into that business.

Meanwhile, NYCHA is in the middle of an ongoing and unfixable crisis. There are probably close to a hundred posts on this website about the unworkable economics of NYCHA. For a relatively recent example, try this one from June 2025. The problem of NYCHA is the fundamental flaw of the socialist model: they have no plan, and never had a plan, to replace and renew the original capital investment when it wears out. Forty to sixty years after construction, the buildings need everything: new roofs, new windows, new plumbing, new electrical, fixing the facade, etc., etc., etc. NYCHA is going around with its cup out demanding something like $78 billion from some combination of State and federal taxpayers. But nobody has any real idea where any substantial part of the money will come from, or if it comes at all. That’s to fix the existing buildings. And Mamdani wants to double the number of units. It couldn’t be crazier.

Conclusion

From decades of experience, we know exactly where these policies lead. Can anybody really be poorly-informed enough to try again going down the exact same path?

Well, I guess, yes. Their fancy educations have taught them exactly nothing. If there is any thinking behind this at all, I suppose that it is, that wasn’t real Socialism. This time we’re going to do it right! (by implementing the exact same policies that have failed in the past and been abandoned due to failure)